US Mortgage Applications Extend Decrease

The volume of mortgage applications in the US fell

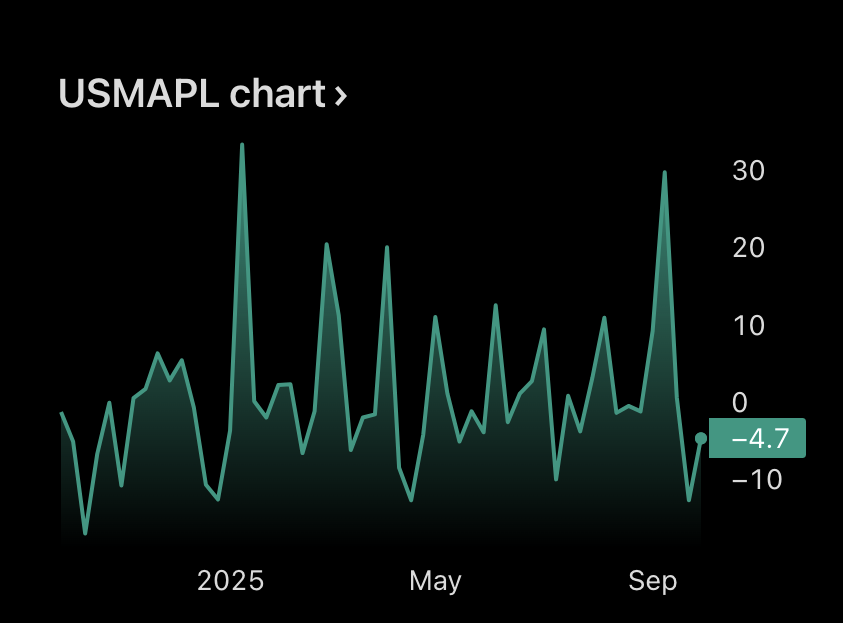

The volume of mortgage applications in the US fell by 4.7% from the previous week on the period ending October 3rd, extending the 12.7% plunge from the previous period.

The pullback further trimmed the combined 42% surge in weekly mortgage applications in the last three weeks despite the fresh drop in benchmark mortgage rates, with home buyers increasingly looking for adjustable rate loans amid the high uncertainty in the direction of US borrowing costs.

Adjustable rate loans made up 9.5% of the total contracts last week, up from 8.4% from the earlier period.

Applications for a loan to refinance a mortgage, which are more sensitive to short-term changes in interest rates, fell by 8%.

In turn, applications for a mortgage to purchase a new home eased by 1%.

-------

The pullback further trimmed the combined 42% surge in weekly mortgage applications in the last three weeks despite the fresh drop in benchmark mortgage rates, with home buyers increasingly looking for adjustable rate loans amid the high uncertainty in the direction of US borrowing costs.

Adjustable rate loans made up 9.5% of the total contracts last week, up from 8.4% from the earlier period.

Applications for a loan to refinance a mortgage, which are more sensitive to short-term changes in interest rates, fell by 8%.

In turn, applications for a mortgage to purchase a new home eased by 1%.The volume of mortgage applications in the US fell by 4.7% from the previous week on the period ending October 3rd, extending the 12.7% plunge from the previous period.

The pullback further trimmed the combined 42% surge in weekly mortgage applications in the last three weeks despite the fresh drop in benchmark mortgage rates, with home buyers increasingly looking for adjustable rate loans amid the high uncertainty in the direction of US borrowing costs.

Adjustable rate loans made up 9.5% of the total contracts last week, up from 8.4% from the earlier period.

Applications for a loan to refinance a mortgage, which are more sensitive to short-term changes in interest rates, fell by 8%.

In turn, applications for a mortgage to purchase a new home eased by 1%.

The volume of mortgage applications in the US fell by 4.7% from the previous week on the period ending October 3rd, extending the 12.7% plunge from the previous period.

The pullback further trimmed the combined 42% surge in weekly mortgage applications in the last three weeks despite the fresh drop in benchmark mortgage rates, with home buyers increasingly looking for adjustable rate loans amid the high uncertainty in the direction of US borrowing costs.

Adjustable rate loans made up 9.5% of the total contracts last week, up from 8.4% from the earlier period.

Applications for a loan to refinance a mortgage, which are more sensitive to short-term changes in interest rates, fell by 8%.

In turn, applications for a mortgage to purchase a new home eased by 1%.